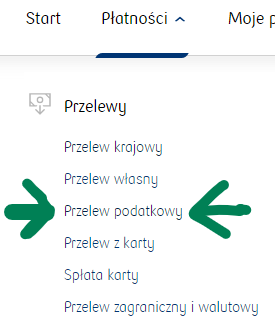

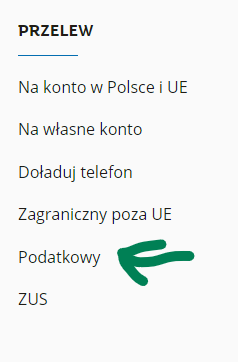

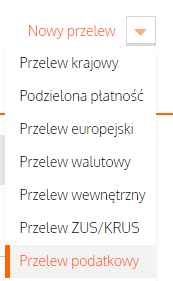

First of all, in Poland there is a requirement to use certain standards in the payment of tax liabilities. This is why you can find a special “Tax transfer” (aka. przelew podatkowy) menu in your online bank service. This option might appear in various places, in various shapes and sizes depending on the bank, where you have account.

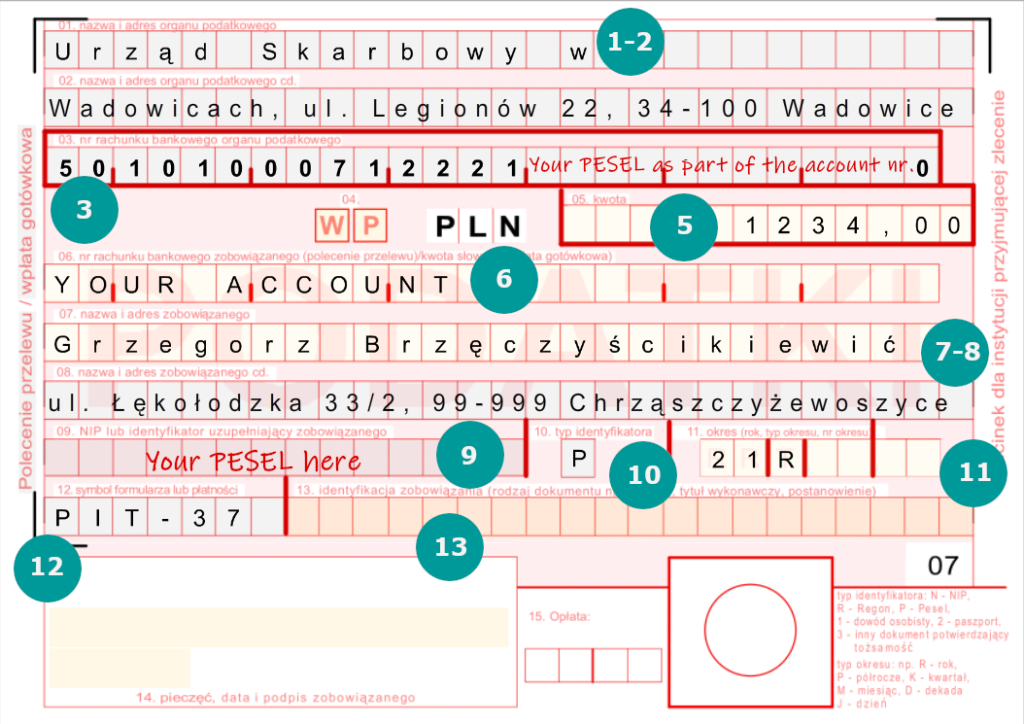

There is a standard transfer order form, that is still in use due to practical reasons. Many utility companies and service providers are using it, attached to their invoices. It has a version that is adapted to tax payments. You will receive one – like this one below – with your annual tax declaration in case you have some sort of tax payable.

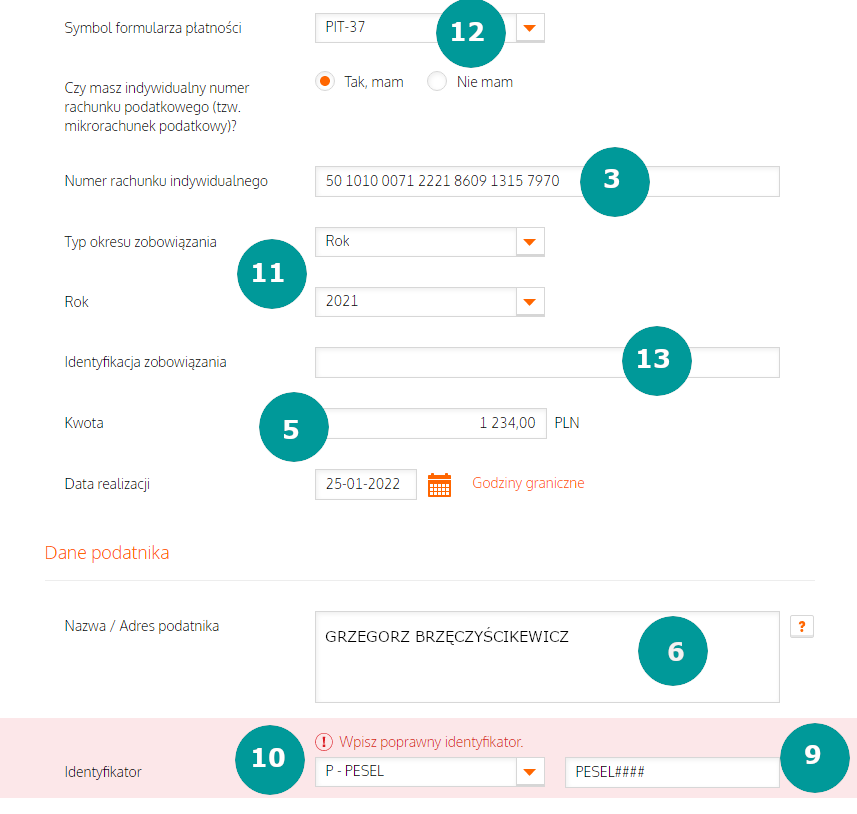

The data you see here filled in is more than enough to make a successful tax transfer.

Each field is numbered and your bank uses the same fields for data input. First you can read a short explanation to the data in the transfer order form, then you will see some examples of tax transfer forms, used by online bank services.

1-2 Tax authority name and address

In case of PIT, CIT and VAT payments this data is no longer required. It might be written on the form, but since the individual tax accounts were introduced, all of the 3 kind of taxes are paid to a single individual account of the taxpayer. The the individual tax accounts, also called as “micro accounts” are managed centrally and will remain unchanged when the taxpayer moves outside of the jurisdiction of the regional tax authority.

3 Tax account

Individual tax account or micro account. The account number to use when transferring the tax liability. You might not know yours, but it takes a moment to find it yourself. Check out this article for more information!

5 Amount

The amout of the tax liability. This is what you will transfer.

6 Account number or amount with words

There was no #4 mentioned previously. Sure, because it is a parameter that is used by payment providers (banks, post offices, agencies) If “W” is marked that mens cash payment, if “P” is marked, that means wire transfer.

In case of cash payment and manually filling the form the amount of the transfer should be written with letters. But since we are lucky enough to live in the 21st century, we are not using cash to pay our taxes (usually).

Since it is not a cash payment, you may still give this form to your bank agent, to make the transfer for you. In this case here, at field #6 you should identify your bank account, from which you whish to pay the amount. But doing it yourself, online you will not not need this parameter filled in. You will chose your checking account in your online bank service.

7-8 Name and address of the payer

This is you and your address. Do not pay taxes for somebody else, in the name of somebody else, etc.

9 Identification

Your – as the tax payer’s – personal identification number. Some sort of it, details at #10

10 Type of identification

Since multiple type of identification can be used to identify the tax payer, in case of personal income tax most likely you will choose letter “P”, that stands for PESEL. Since 2013 a natural person is identified by the tax office by PESEL, unless it is a registered entrepreneur. In that case the identification is NIP (letter “N) on the form

If you take a magnifying glass, you can check, what other options would be available on the form, but in case of PIT, only these two options are available:

P – PESEL

N – NIP

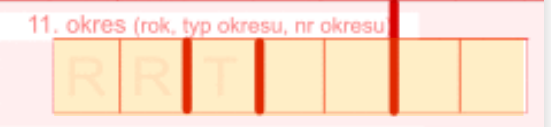

11 Period

Specify the time frame, when your tax was generated.

PIT declarations, like PIT-37, PIT-36, PIT-38, PIT-39 or PIT-28 are annual. (“R”)

First we write the last two digits of the year (RR), the type of the period we define by a letter. Most likely R.

Let’s take our magnifying glass again and check the options we have:

R for annual

P for sermi-annual

K for quarterly

M for monthly

or shorter (rarely used).

Since R stands for an annual tax, no further information needed, In case of quarters, months, please fill in the next two boxes with the number of the period. E.g.:

21K04 – fourth quarter of 2021

19R – the year of 2019

20M08 – August, 2020

12 Symbol of the form

This is the symbol of the form on which you declared your taxes,

If you have income only from employment and you can use a simplified form, likely you will file PIT-37 (Order here!). If you have income with flat rate taxation it would be PIT-28.

13 Identification of liability

Just leave empty. As long as nothing specific comes to this field, it is ok.

How to do it in my online bank?

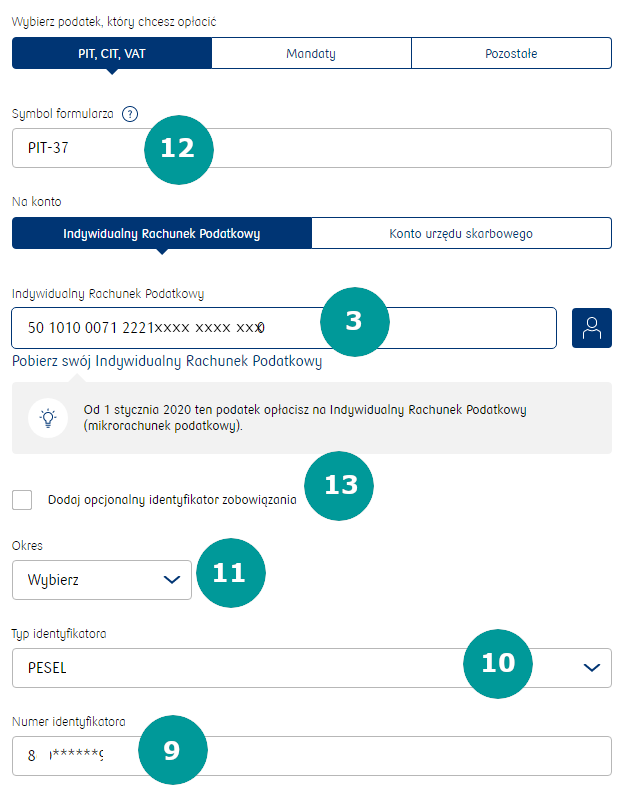

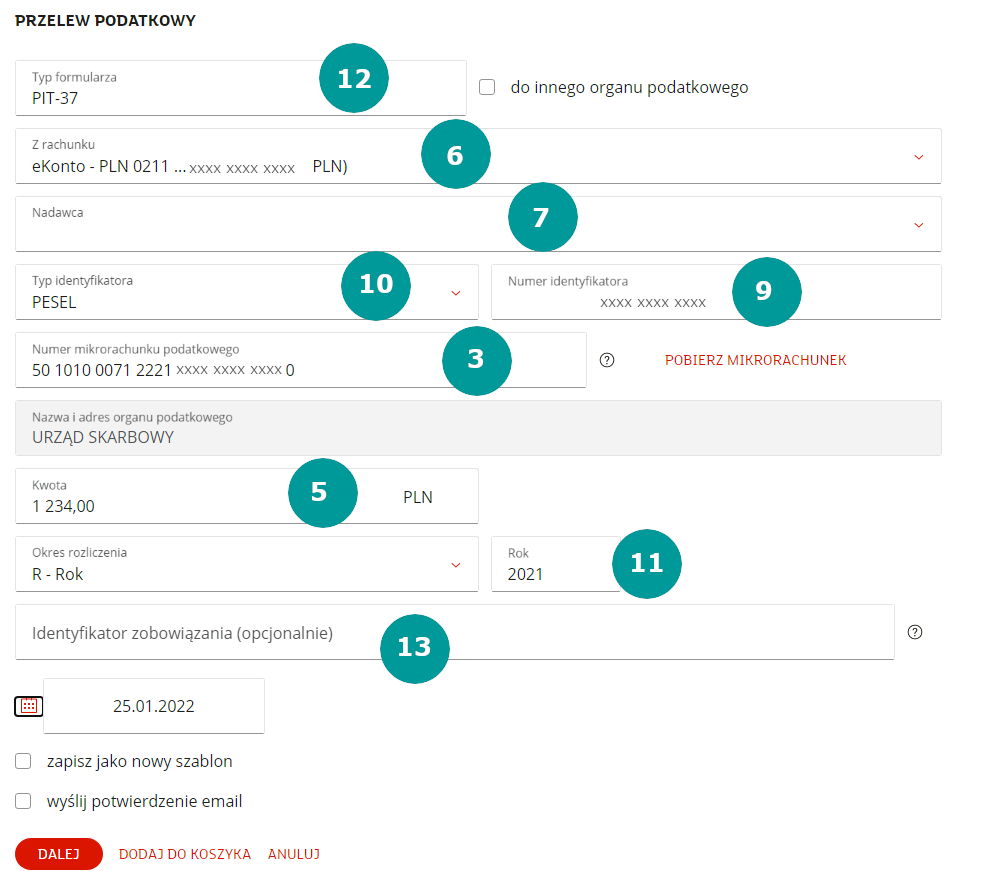

In the below figures you will se 3 examples, from 3 different banks. The name of the input fields and the structure has to be somewhat similar to these in other banks as well.

HINT:

I numbered the fields just like they are numbered on the tax transfer form. Feel free to take a peek in the filled form, you received with your tax liability and compare with the input fields in your online bank service.

PKO BP

Mbank

ING Business