In this article I collected a set of frequent misconceptions regarding the annual PIT declaration(s). All of these I heard from actual Clients This list is a “TOP 10” only and can be continued infinitely. I hope you find it useful. If there is a misconception you heard about and might be worthy to discuss it in details, please let me know!

1. They will prepare for me at work

Nope. This is the biggest misconception I ever heard and the most frequent one.

I heard about promises from some team leaders, lower-mid level managers, HR partners regarding this, but when the time of the declaration arrived it turned out that the dear tax payers is left alone with their declaration, because nobody has time for that at the office, it is not allowed for the employer to prepare the tax declaration of an employee, for one reason of for another, anyway everyone is busy, anyway everybody does it for themself.

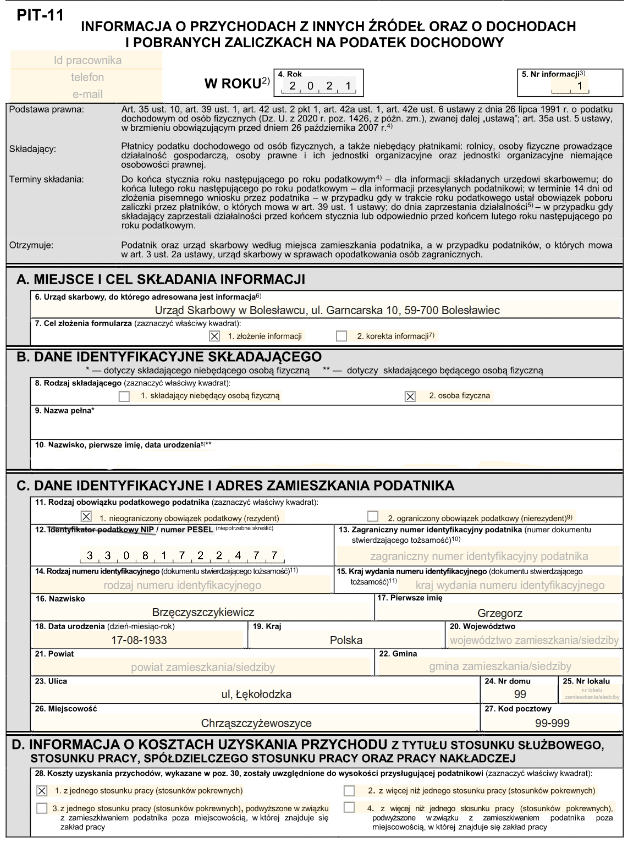

“But I received the PIT-11-et”

Sure you did! The income statement on the PIT-11 form has to be delivered by the employer until the last day od February to each employee whom salary was paid in the previous year. This might be a nice form including lots of data, but this will not be your tax declaration.

“They said it was submitted”

Who did tell you that? Is it really enough for you, when someone says it was submitted? What if someone else would ask you the question: When did you file your declaration? or How much was the payable tax amount on your previous declaration?

Yes, there might occur questions like that and in some situations you might need to answer these. In case somebody else would prepare your declaration for you, make surem that

- the tax office received it,

- it takes into consideration all the possible tax benefits you are entitled to,

- it has the correct bank account number for the purpose of any refund,

- that bank account number is the same one you provided to the tax office earlier on the ZAP-3 form,

- in case of any payables, these items were transferred to your individual tax account before the deadline.

“But I had only one employer”

Yes, in that case you still need to submit your declaration. If the local tax office finds that you did not file your declaration until the deadline, they prepare one for you. based on the data they have. Taking into consideration the possibilities provided by the current system of payroll accounting, taxes, tax benefits, discounts and contributions, you might have tax overpayment receivable or income tax payable as well. In case there is tax payable on this declaration prepared for you by the tax office, you are obligated to pay it before the deadline, This means, you are already late with your tax payment and interests have to be calculated. You will find out about the amount, when you receive a subpoena in a registered letter, certainly with the added administrative costs.

It is naturally possible that the tax office is not aware of some circumstances, that might provide discounts on your taxes, So if you pay a little attention, these payable items might not appear at all.

2. No I will get back my tax

If you would receive it back, why would you pay it? Sure, there is the phrase of “tax return” known in the literature, but it should be understood as the act of filing your tax declaration.

Personal Income Tax is the sort of tax that we pay only one time each year. Yes, the employer pays it monthly, entrepreneurs, landlords do pay it monthly/quarterly, etc. All of these payments during the year are only down payments on personal income tax. The clearing of the down payments during the year is done together with the annual declaration. If the sum of down payments exceed the tax amount calculated on the declaration, you will receveiv tax return. In case the calculated tax is higher than the sum of your tax down payments, you are obligated to pay that tax – accordingly – until the deadline of the annual declaration.

3. One PIT-11 from my recent employer is enough

If you worked for one employer in the given calendar year, this is true. If your employment ended in the year before the current one, but your salary was paid already in this year, you should expect to receive an income statement from that previous employer.

To sum up, there should be a statement on every income, PIT-11, PIT-8AR, PIT-8C or other. If you had income from multiple sources, than your declaration prepared based on one source will be incorrect (and the error will be discovered earlier than you think).

4. I am not Polish citizen, I do not have to prepare tax declaration

You have to. If you had income from Poland and from the following two statements at least one is applicable for you, you have to submit PIT declaration.

- You spent at least 183 days in Poland through the calendar year (The 183 days do not necessarily follow each other, it can be randomly interrupted a number of times that is mathematically feasible)

- The center of your personal or economic interests is located in the territory of Poland.

Factors determining the center of personal interests are:

- family relations (souse, children), social relations

- social, political, cultural and sport activities

Factors determining the center of economic interests are:

- source of income

- place of any activity that generates personal income

- real estate or investment ownership in the teritory of the country

- bank account in Poland

- taken out loans

- the place where from the person manages its wealth.

If you are not sure, whether any of these would be applicable for you, ask your accountand and describe your situation.

5. Under the age of 26 i do not have to declare taxes.

Being under 26 and not paying PIT does not mean, that you do not have to declare your income. Afer checking the limitations and certain exceptions, it will make sense to file the tax declaration.

Under the age of 26, your salary from employment is free from tax, but you pay contributions to social security, like healthcare contribution and social insurances..

The amount of income free from tax is limited to 85.528,- zł. The part above this amount is taxed.

Only your income from employment is free from personal income tax, that you receive based on an employment contract or based on a contract of mandate. Income from any different source is taxed regardless.

6. If spouses declare their income together, they pay less tax

There are situations when this statement is true, but you should not expect enormous amounts of tax return just due to this fact. First of all, the tax rates are not changing. In case the amount of calculated tax down payments of the couple significantly differ from each other, then joint tax declaration might me beneficial.

In case of joint declaration the base of the tax calculation is the average amount of the income of two people, therefore it is possible, that while one of the tax payers has down payments deducted on 32% rate, the income of the other party remains below this level. The average of their income may not exceed or just slightly exceeds the level, where it is taxed with 32% rate,

What conditions have to be fulfilled to declare income tax together wit your spouse?

- The couple has to be married at least on the 31st of december in the current year. (Until 2021 at least 365 days spent in a year as a married couple was the prerequisite)

- Other than marriage, the material properties should not be divided between the spouses. In case there is an agreement between the spouses that divides their property or discloses the common use of that, joint declaration is not allowed.

- Non of the spouses uses linear taxation (PIT-36L) or flat-rate taxation of the revenue (PIT-28), except of income from rent. If the spouses have income from other sources that is taxed on the tax scale, those should not be calculated to the joint tax base. These items have to be added to the tax base afterwards.

- Both of the tax payers are residents in Poland

- They requested the joint taxation in the tax declaration or in the correction of their previous PIT declaration, ot in a separate application in case of declarations submitted after the deadline.

7. I did not pay last year, I will not pay this year either

I heard this argumentation as well. Not sure that it is convincing from every pont of view. Your income may vary and the regulations are definitely changing.

Alone in 2019 there were 14 changes made to the Act on Personal Income Tax by the legislators. In 2020 this number was 16, in 2021 it was 7. And in 2020 came Polski Ład. Excluding additional decrees and “emergency” half-legal moves, the legal act was changed 31 times. At multiple points at a time. Do you follow? Are you counting? Do you follow?

I hope your answer to the last question is “Yes”, since you are here reading this article. To sum up, if you used to receive refunds through all the years and now a payable amount appears at the end of your declaration, do not be surprised!

8. I am not living in Poland anymore, so I do not have to submit my declaration

This is not the correlation you are looking for. It depends on the Tax Residency, that I described at the 4th example. If/When you moved abroad, you still need to file a tax declaration in Polandm especially when you still had income from something you did in Poland.

9. The tax return is paid only to Polish bank accounts

It may sound strange for some people, but the public administration in Poland knows about the existence of different countries outside of Poland. On the tax forms there is even a filed for the country name and the clerks will not get confused if you give them a phone number with a country code other than +48.

For the purpose of the tax refund the bank account number must fulfill some criteria,

Adóvisszatérítésnél a bankszámlaszámnak meg kell felelnie néhány kritériumnak:

- The neme of the account holder and the name of the tax payer has to match. (In some cases 100% match is not possible, due to the limitations of the character encoding)

- The account number must be in IBAN format. This means, that the refund can be issued only to those countries, where the banks are using the IBAN standard.

- In case of any non-Polish banks there is a separate filed for the country of the bank and for the SWIFT code / BIC. These parameters are required.

- In case of local (Polish) bank account number format, the “PL” from the beginning is dropped, because this is the only difference from the IBAN standard.

10. In May, right?

Noooo! It never hurts to keep in mind the deadlines. The deadline of personal income tax declaration is April 30th. The only exception was the PIT-28 form until last year, but since 2022 even this one will have the same deadline.

So if you leave it for May, you are late!

For some of my Clients it is a natural thing, that after the fiscal year that ends on June 30th, they have time ti file their taxes until the end of August. For others it makes sense to start the fiscal year in March. In Poland the fiscal year for every physical person is always the same as the calendar year. The deadline on April 30th is adjusted right to this parameter. The earliest possible filing of tax declarations is on February 15th, because the official forms of the declarations have to be issued/distributed until then.

Is there something else that is not clear yet?

The list I brought here is certainly longer, but this part of it is sufficient to present misbeliefs. If you happened to have questions on this topic, you will find me in the office.