The PIT-2 form is the taxpayer’s declaration to the employer on the deduction of the tax credits from the tax advance – will be radically changed. You will have an employment contract in 2022 or an assignment contract that will continue in 2023, you will more than likely come across this form.

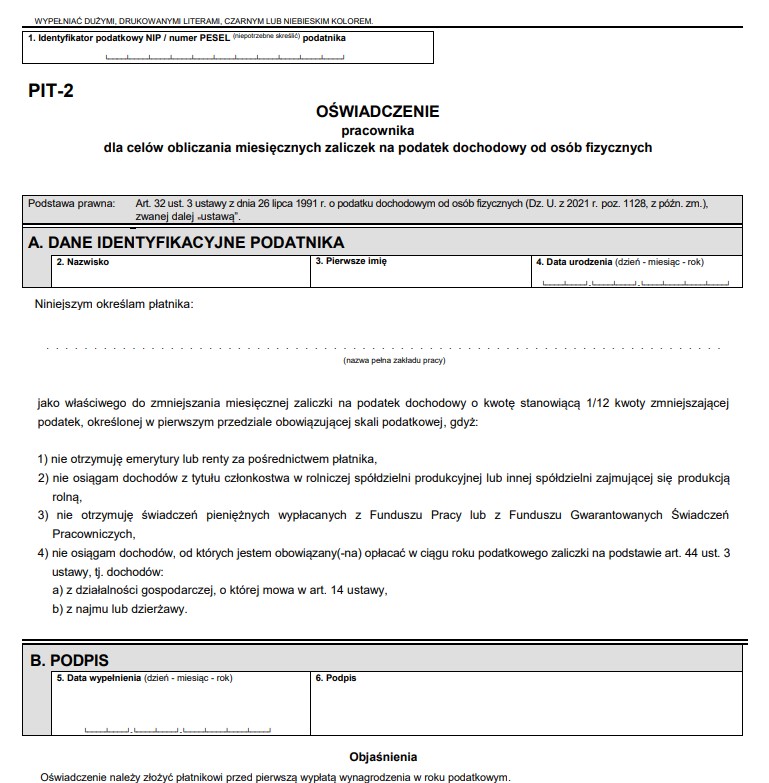

The predecessor

Until 2022, this declaration was for a pro-rata reduction of the annual tax-free portion of the monthly income tax advance carried forward by employers.

On 1 January 2022 (and since then), a series of tax reliefs were introduced, not all of which have been in force for a full tax year and require a declaration by the taxpayer to qualify for them. For these, businesses, accountants, tax advisors and lawyers have been preparing specific forms in recent years, some of which may be retired with the release of the new PIT-2.

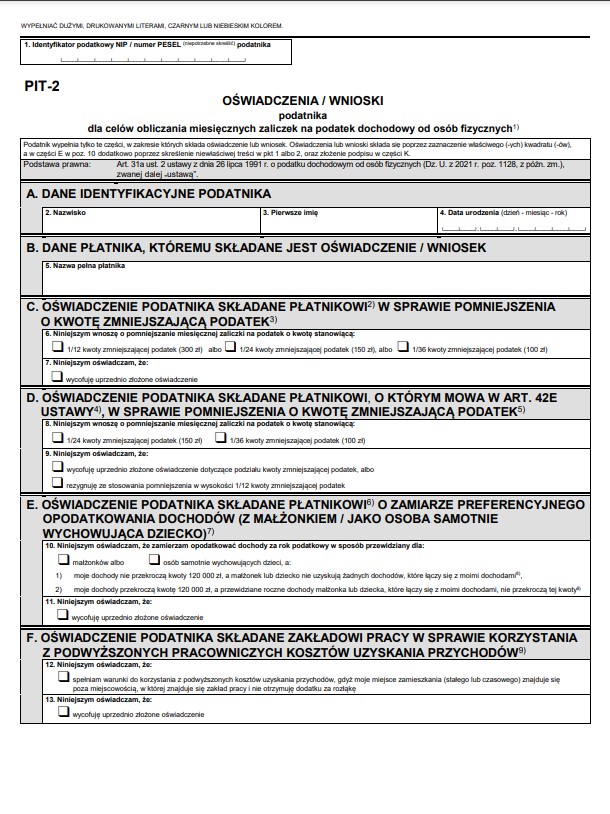

The successor

… ended up being a little longer, but hopefully more useful.

The full document can be viewed and downloaded here.

How to fill?

No doubt this form also serves a purpose and there was a reason for its “enrichment”. Most employees are required to fill it in when they start work or before the next tax year to inform their employer.

We are left with the question: How to do it?

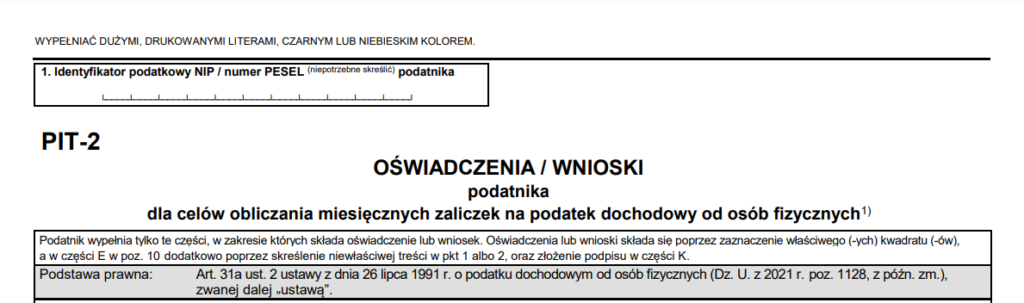

Header

In the header section of the form enter your tax identification number. Since 2013 this will be PESEL by default. If you are a sole proprietor, then it will be NIP.

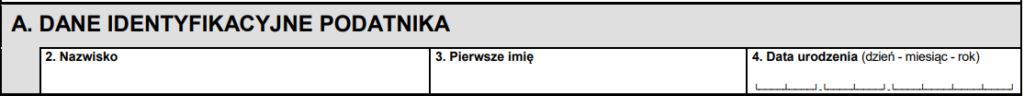

Part A

Section A is the only one remains unchanged after the previous versions. Enter the following data here in this order:

- Surname

- First name

- Date of birth in dd.mm.yyyy format

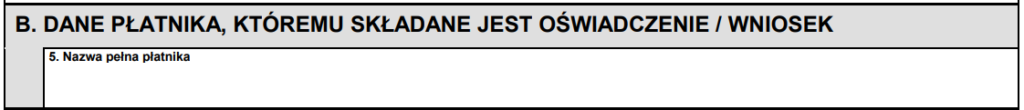

Part B

In Section B name your employer. If you are not 100% sure about the correct name, check it on your contract.

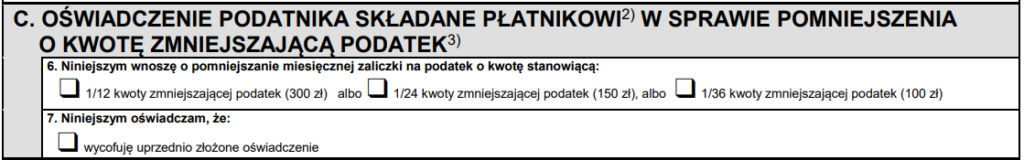

Part C

In Section B name your employer. If you are not 100% sure about the correct name, check it on your contract.

The first 30.000.- zł is free of tax for all tax payers. The employer has the right to reduce your monthly tax down payments with this amount.

If you work for one employer, you can request a decrease of 300,- zł.

If you work for two employers at the same time, you can request both of them for a monthly decrease of 150,- zł at each one.

You have the possibility to ask your employer to decrease your taxes by 100 zł/month only.

You may request the reduction of your tax relief if you simply wish to pay more tax from your wage during the year, so you could receive a tax return at the end of the year.

In case you leave filed #6 blank – without selecting anything, that means you do not have a request about your monthly tax relief amount. Your employer should not take it into consideration, therefore you may claim this tax benefit with your annual declaration, sometime between February 15th and April 30th next year.

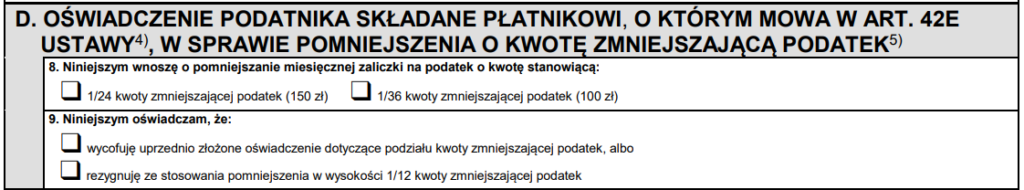

Part D

Section D regards the those tax payers, whose salary is paid by bailiffs or a tax payer different from the employer and not a direct successor of it.

In such cases the 300 zł monthly tax relief is applicable by default. In field #8 the tax payer may request this to be decreased.

In field #9 the statement made earlier may be withdrawn or the tax payer may waive the application of the monthly tax relief.

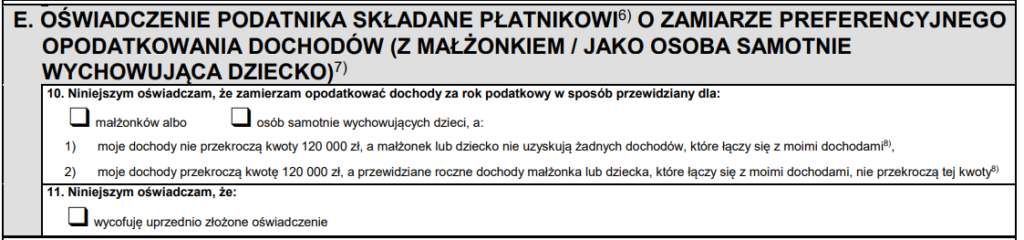

Part E

Section E regards joint taxation of spouses and single parents with their children.

In filed #10 you may declare, whether you wish to file your taxes together with your spouse or child, then specify the cause of it.

At the end of the sentences marked by 1) and 2) you see a reference with a number 8). This says “strike out which is not applicable” (instead of mark the applicable one. Positive language! 😉)

If your expected annual income remains below 120.000,- zł and your (above mentioned) spouse or child does not have income, that would be added to yours, you leave sentence 1) clean and readable and you strike through the other sentence with one straight line.

If your expected annual income will exceed 120.000,- zł and your (above mentioned) spouse or child does have an income lower than 120.000,-zł, you leave sentence 2) clean and readable and you strike through the other sentence with one straight line.

When you file PIT-2 with your declaration from section E, the employer needs to take into account this fact at the calculation of the monthly tax and tax relief amounts. If your spouse/child would have income that was not expected when you filed your PIT-2, you may withdraw your statement during the year by selecting the filed #11.

If you do file your taxes together with your spouse every year and therefore, you were entitled to tax returns each year, but now you give your statement to your employer on joint taxation, that means you may receive more money on the monthly level, but you should not count on tax return at the annual declaration.

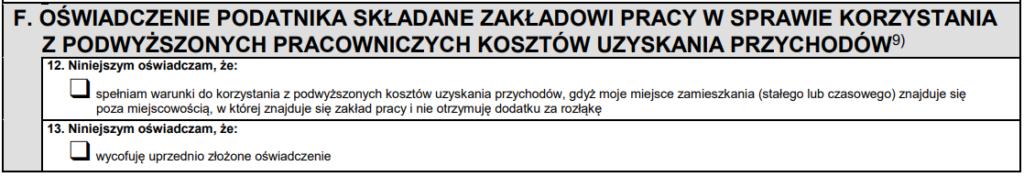

Part F

Section F is your statement on the raised cost of your revenue.

According to Art. 22 paragraph 2 of the Act on Personal Income Tax, the cost of earning an income from employment is:

- 250 zł monthly and 3.000,- zł annually – in case the tax payer earns its income from one service relation, employment, cooperative employment relation or contract work;

- This cost may not exceed the annual 4.500,-zł, in case the employee might have more service relations, employments, cooperative employment relations or work contracts;

- 300 zł monthly and 3.600,- zł annually – in case the permanent or temporary residence of the tax payer is located in a settlement (township) different from the settlement where the place of work is located and the employee does not receive compensation for commuting.

- The annual cost may not exceed the 5.400,-zł, amount in case the employee has more service relations, employments, cooperative employment relations or work contracts AND the permanent or temporary residence of the tax payer is located in a settlement (township) different from the settlement where the place of work is located and the employee does not receive compensation for commuting.

Simpler: If you commute from a different town to your workplace, you mark the square #12. When this changes, meaning either you move to the town where you work or your workplace moves to the town where you live, you mark the square #13.

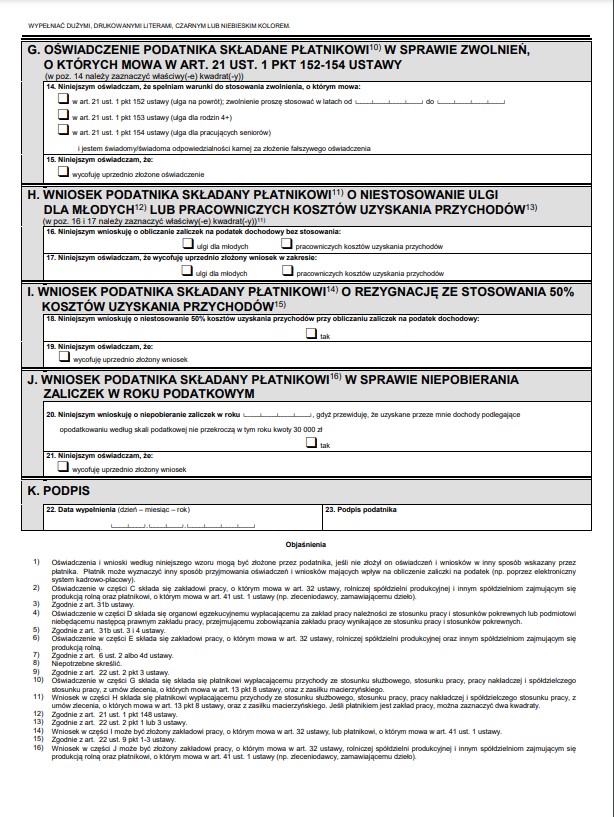

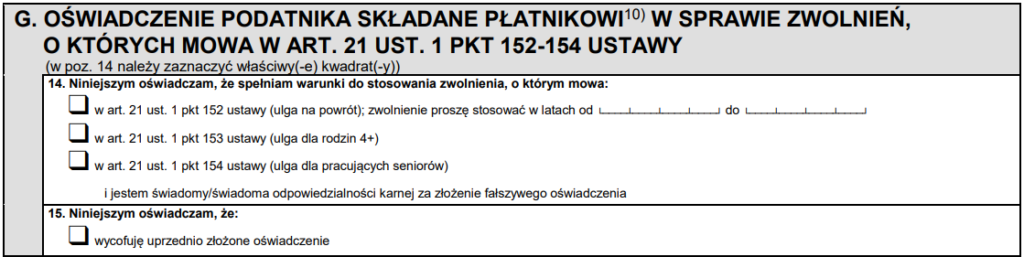

Part G

Declaration on tax exemption.

- Art. 21 paragraph 1, point 152 – The tax exemption of the returning

If you are entitled to the „exemption of the returning” mark the first square and specify the first and last year, when you are entitled to use this benefit.

- Art. 21 paragraph 1, point 152 – The „four plus” family exemption

In case you are practicing parental supervision or legal guardianship over at least 4 (four) children living with you, in your household, mark the second square.

- Art. 21 paragraph 1, point 152 – Exemption of working seniors

If you reached the retirement age (ladies 60, gentlemen 65 years) and you remain an active employee, let your employer know it, by marking the third square.

If you marked one of the squares in field #14, your employer will not deduct tax down payments on the first 85.528,- zł you earn.

By marking filed #15, you can withdraw your previous declaration.

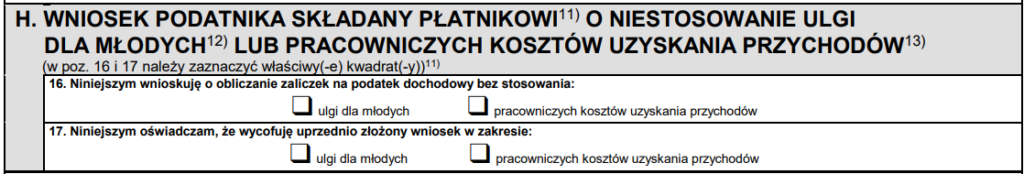

Part H

Tax exemption of the youth

For employees under the age of 26, earning the first 85.528,- zł income is tax free. As long as the income of the young employee remains under this amount, the employer does not deduct tax down payments and disregards the cost of earning the revenue. (Refer to part C of the form.)

In case the young employee takes a different job at a different employer and already reached the 85.528,- zł income in the year at the first employer, needs to make a declaration in field #16. By marking the first square declares that she/he is no longer entitled to the tax benefit for the employees under the age of 26.

In the second square the employer may be requested to disregard the cost of the revenue in the salary calculation.

In the field marked with #17 the two earlier mentioned declarations may be withdrawn. In case the young employee remains under the age of 26 until the end of the year, and already earned 85.528,- zł amount in the current year, it is advised to withdraw the declaration made in field #16, so she/he could use this tax benefit in the next year, starting from zero.

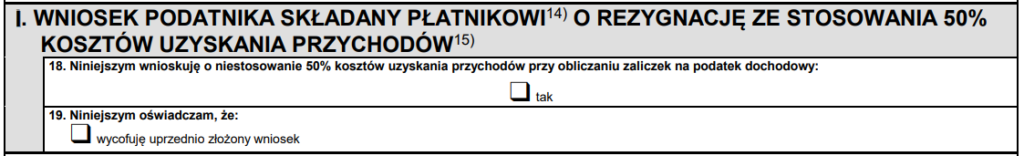

Part I

resignation from the 50% cost of revenue

In case of employees, whose payroll regards copyright and related rights, may account 50% of their revenue for the cost of their income. The limit of this cost is the income limit of the lower tier of the personal income tax calculation, which is currently 120.000,- zł.

Ha aIf your work at your employer generates copyrights or related rights and it is visible on your payroll with a 50% cost, then it cannot be higher than the 120.000,- zł amount. If your income already crossed this line, select the „yes” square in field #18.

It is practical to withdraw your declaration in December, before the new year, so you could start again from zero.

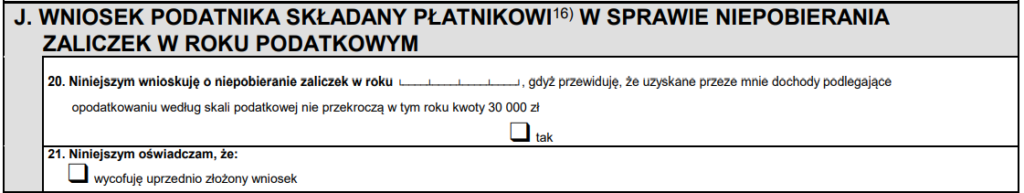

Part J

Request to waive the levying of tax down payments.

Your declaration made in filed #20 regards one year only. If your expected annual income does not exceed the tax free (30.000,-zł) amount, you may request your employer not to deduct personal income tax down payments, just because you could claim as a tax return at the end of the year. In the lucky situation if this would change, you may withdraw your declaration, that you made in field #21.

You may use this declaration even if you are working with a contract of mandate (umowa o dzieło, umowa zlecenie), therefor in 2023 a contract of mandate is not a disadvantage anymore compared to an employment contract.

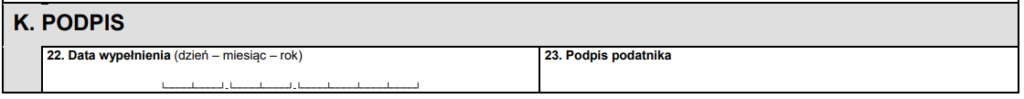

Part K

Date, signature

Enter the date of your declaration into filed #22 in dd-mm-yyyy format. And sign your PIT-2 form in field #23.

Before you submit

Before you would file it, make a copy for yourself! This is important, so you could look up later what declarations you made on the PIT-2 form.