- Social insurances (and yes, it is plural)

- Health insurance

Let’s start with the purpose of the ZUS payments. What kind of insurances do we pay?

Social insurances

The rate of your contribution

The proportions of the contributions in 2026 will still remain the same as last year. You can see the rates in the table below.

| Retirement pension | Disability pension | Sickness insurance1 | Accident insurance2 | Labour fund3 | Fund of guaranteed employee benefits4 |

| 19,52% | 8,00% | 2,24% | 1,67% (0,67-3,33%) | 2,45% | 0,10% |

- The sickness insurance is voluntary. Not obligatory, but in case of an incapacity for work longer than 30 days this insurance pays you the sickness benefits, A person is entitled to receive sickness benefits – maternity benefits as well – if it was insured by this sickness insurance for longer than 90 days before its incapacitation for work.

- The rate of the accident insurance depends on the characteristics of the work one does. In case of sole entrepreneurs, who empoy 9 or less people covered by social insurances, are obliged to pay half of the highest rate. This is 1,67% starting from april 1st, 2018.

- An exempt from labour fund contribution is an entrepreneur that

- employs people based on mandate agreements only

- is a “new” entrepreneur and pays the social contributions after a preferential base

- has less than 5 years until reaching retirement age

- pays social insurances from a base lower than the minimal wage.

4.Only after employees

The base amount of the contributions in 2026

For entrepreneurs, the base for monthly social security contributions is 60% of the average income predicted for 2026. The average income forecast for 2026 is PLN 9,420 (60% of the forecast income, 9,420 * 60% = 5,652)

For those paying reduced contributions, known as ” Small ZUS “, the contribution base is 30% of the current monthly minimum wage. In 2026, the minimum wage will be PLN 4,806.00 from January 1. This will also increase the basis for social security contributions. (30% of the minimum wage, PLN 4,806.00 * 30% = PLN 1,441.80)

The contribution values are calculated as follows:

Base amount: 5 652,00 zł

| Retirement pension | 1103,27 zł |

| Disability pension | 452,16 zł |

| Sickness insurance1 | 138,47 zł |

| Accident insurance2 | 94,39 zł |

| Labour fund3 | 138,47 zł |

| TOTAL with sickness insurance: | 1 926,76 zł |

| TOTAL without sickness insurance: | 1 788,29 zł |

Base amount of “Small ZUS” is: 1 441,80 zł

| Retirement pension | 281,44 zł |

| Disability pension | 115,34 zł |

| Sickness insurance1 | 35,32 zł |

| Accident insurance2 | 24,08 zł |

| Labour fund3 | -,00 zł |

| TOTAL with sickness insurance: | 456,18 zł |

| TOTAL without sickness insurance: | 420,86 zł |

Health insurance

On the tax scale (17%/32%)

Change compared to 2025:

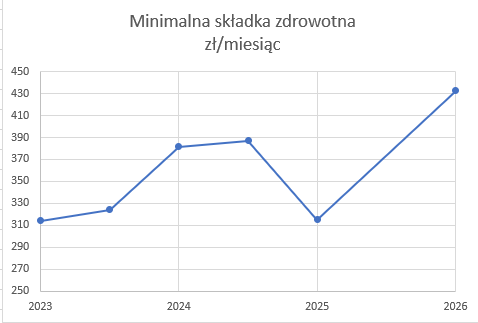

The monthly payment is 9% of monthly income, but no less than 9% of the gross minimum wage. (Since the adoption of the Polski Ład legislative package until 2024)

In 2025, according to temporary legislation valid for one year, the minimum health insurance contribution was 75% of the above amount, which reduced the monthly burden on small businesses. The Sejm wanted to maintain this for 2026 as well, but the bill was vetoed by President Karol Nawrocki and subsequently rejected.

After January 1, 2026, the minimum monthly health insurance contribution will be (instead of the expected 324.41. zł),

432,54 zł

On linear taxation (19%)

The monthly payment is 4.9% of monthly income, but no less than 9% of the current minimum wage, i.e., in 2026, the aforementioned 432.54 zł. (Also instead of 324.41 zł.)

It is important to note that those who opt for the linear 19% tax rate waive their right to the tax allowance on the first PLN 30,000 of their income, joint taxation of spouses, tax allowances for children, and many other benefits. You can find a summary of the deductions you can apply in your PIT-36L (linear) tax return here.

Since July 2022, those who choose linear taxation have been able to deduct 50% of their health insurance contributions from their taxable income, provided that they have not already accounted for them as expenses. The deductible amount could be as high as PLN 12,900 per year in 2025. From 2026, health insurance contributions will not be deductible from tax or the tax base at any level. This could increase the tax payable by entrepreneurs using linear taxation by at least PLN 493, but by as much as PLN 2,500.

The amount payable monthly is 4,9% of the income, but non less than 9% from the 75% of the current minimal wage, the above mentioned 314,96 zł.

It is important to note that those opting for the linear 19% tax rate, will forgo tax relief on their first income of zł 30,000, joint taxation for spouses, childcare tax benefits and much more.

Since July 2022, people opting for the linear tax system will be able to deduct 50% of their health insurance contributions from their taxable income if they have not already deducted it as an expense. The deductible amount cannot exceed PLN 12,900 per year in 2025.

With flat-rate taxation

In case of the flat-rate taxation (Ryczałt) of the income the legislator determines 3 levels.

The contribution base is calculated on the basis of the average income of the entrepreneurial sector in the fourth quarter of the previous year, which is published by the Statistical Office (GUS) by 20 January of the following year.

The amounts applicable from February 2026 are:

As of today, we only know the amount of social security contributions, The amount of the basic health insurance contribution is expected to be published by the Statistical Office (GUS) on 20 January 2025. The values are updated in the table below.

| Annual income | monthly amount | annual amount |

| below 60.000 zł | 498,35 zł | 5.980,16 zł |

| between 60.000 and 300.000 zł | 830,58 zł | 9.966,93 zł |

| above 300 zł | 1495,04 zł | 17.940,48 zł |

The annual income here regards the income of the current year, 2026. The income of the previous year will determine the amount of monthly payments,

One of the countless changes in the moderately successful provisions of the legislative reform called Polski Ład is the possibility to deduct 50% of healthcare contributions from the tax base. (It is important to mention, that the amount is deductible from the tax base, just like the social contributions and it is no longer deducted from the actual tax amount.)